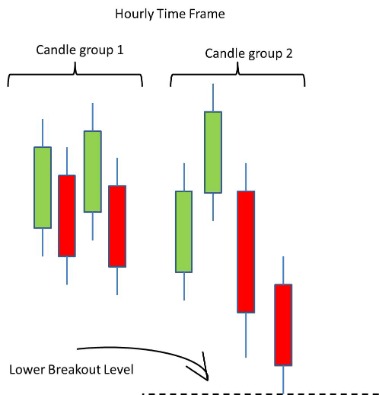

Thank you for taking the time to test the candlestick reversals. I have a list of best performing candlestick patterns as suggested by Thomas Bulkowski. However, the horizontal line position on a Doji candle can indicate the traders’ sentiments during that session. A relatively central horizontal gravestone doji candlestick pattern line indicates indecision, with traders unwilling to take a bullish or bearish position either way. Candlesticks always show the same four pieces of information. They display the highest and lowest price for the trading session, indicated by the thin “wicks” at the candlestick’s top and bottom.

Tech view: Gravestone Doji pattern on Nifty charts; tread with caution – Economic Times

Tech view: Gravestone Doji pattern on Nifty charts; tread with caution.

Posted: Wed, 01 Jun 2016 07:00:00 GMT [source]

On the other hand, its occurrence in a downtrend hints at a potential upside retracement. A Gravestone Doji represents an inverted T-shaped candlestick, with the open and close coinciding with the low. The candlestick indicates that the buyers attempted to increase the price but could not sustain the bullish momentum. If the closing price is right in the middle, it could be considered a trend continuation pattern.

Get My 6-day FREE Trading Course That You Can’t Afford to Lose

As you can see, the strategy of shorting a gravestone doji and holding for one day produced an average loss of -0.27% in our 21 markets with an average win-rate of 45%. And it produced an average loss of -0.18% in stocks with a win rate of 43%. Assuming that they confirm a bearish pattern is about to emerge, traders can use these signals as the basis of closing out long positions and opening shorts. Ideally, the gravestone doji is usually a reversal pattern, especially when it happens after a strong rally of an asset.

This type of Doji is not a reliable pattern and can be ignored. So, for example, when Bitcoin (BTC) opens and closes at $20,000 on a particular day even if its price seesawed between $25,000 and $15,000 throughout the given24-hour period. Depending on the strength of the trend, different levels are more likely to work better with the Gravestone Doji pattern. Here you can learn more about the different Fibonacci retracement levels.

Day Trade the World Staff

In this quick 10-minute guide, we’ll get you to an expert level of understanding on identifying Gravestone Doji candle chart patterns and how you can use them to capture more profits. Deepen your knowledge of technical analysis indicators and hone your skills as a trader. As shown in the first example above, a dragonfly chart is the exactly opposite of the gravestone doji. It happens when the price opens, falls, and the bulls push it higher to the open. We will help to challenge your ideas, skills, and perceptions of the stock market. Every day people join our community and we welcome them with open arms.

Bearish Bitcoin Signal Could Send Bulls To Early “Grave” – NewsBTC

Bearish Bitcoin Signal Could Send Bulls To Early “Grave”.

Posted: Thu, 12 Aug 2021 18:55:16 GMT [source]

Dragonfly doji can also be used to confirm bullish uptrends in the following chart showing the S&P 500 SPDR (SPY) at a different point in time. In this case, traders looking for an entry point into the uptrend could have used the dragonfly doji as a confirmation that the uptrend would continue. If it has a long upper shadow, it signals a bearish reversal.

How to Trade the Dead Cat Bounce

In this post we will breakdownthe Gravestone Doji Candlestick by understanding the meaning of what it’s trying to tell us. This will ensure that you don’t have to memorize the candlestick name. In fact, once you’re done reading this post, you’ll never have to reference it again. Watch our free 7-minute tutorial on how pro traders harness unusual option activity. Your trade should only trigger the low of the Doji breaks down.

The shooting star and the gravestone Doji candle are a single candlestick pattern that indicates a trend reversal and has a similar chart formation. Trading the gravestone candle pattern is straightforward to understand. As a trend reversal indicator, traders are looking to enter a position when the gravestone candle is completed, and the following candle signals that the market is about to reverse.

Examples of Gravestone Doji in Uptrends and Downtrends

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money. Cant wait for you to update your Udemy courses with more trend following and momentum strategy. Was pretty amaze by the reversal percentage according to his backtest.

- Deepen your knowledge of technical analysis indicators and hone your skills as a trader.

- We put all of the tools available to traders to the test and give you first-hand experience in stock trading you won’t find elsewhere.

- To confirm the pattern’s bearish reversal signal, we used RSI and MACD – two of the most popular and effective momentum indicators.

- People come here to learn, hang out, practice, trade stocks, and more.

- After an uptrend, the Gravestone Doji can signal to traders that the uptrend could be over and that long positions could potentially be exited.

This pattern indicates the market’s indecision about pricing direction. However, an area of resistance is found at the high of the day and selling pressure pushes prices back down to the opening price. Therefore, the bullish advance upward was rejected by the bears. Once you’ve mastered the basics, you’ll be able to develop your own style. With a 3-day holding period (right table), the pattern also did poorly.

Although reliability increases with volume and a confirming candle, the gravestone doji is best accompanied by other technical tools to guide trading. The opposite pattern of a gravestone doji is a bullish dragonfly doji. The dragonfly doji, which isn’t a very frequent pattern, looks like a “T” and it is formed when the high, open, and close of the session are all equal or nearly the same.